Author: Mike

Families Helped

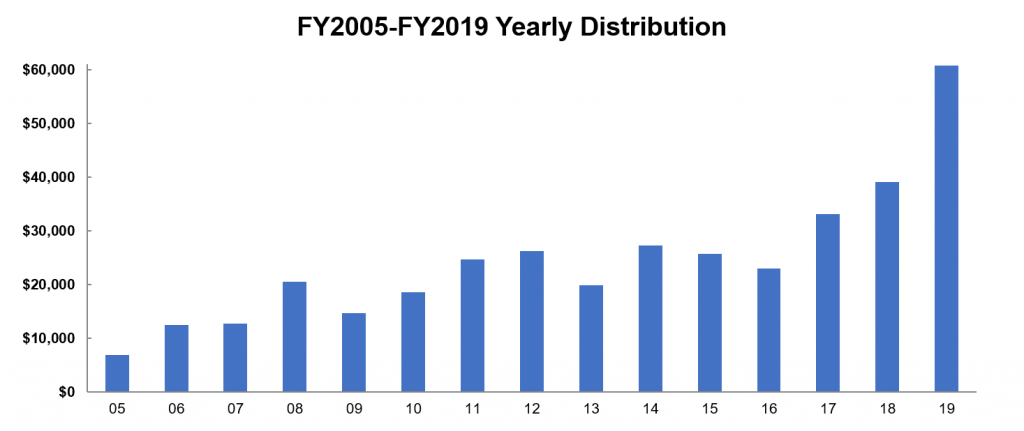

For nearly fifteen years OMR in conjunction with the Howard Community Action Council, has helped 267 working families. Without assistance, many of them faced eviction. Thanks to your help, OMR has collected and distributed an average of nearly $20,500/year to families in need. Since operating expenses are absorbed by OMR board members, all donated money goes to help families.

Here are some recent situations where OMR has helped:

- A fire destroyed the apartment of a single parent of a 6-year-old. We were able to help with the first month’s rent after she managed the security deposit.

- A woman who supports a child and a grandchild was hospitalized due to illness, losing pay as a result. We were able to cover the rent payment.

- A single parent of four began working for the school system in April but was not paid during the summer. We assisted her with a rent payment.

- A single mother of two went to live with her mother after her husband put her possessions out of the house, changed the locks, and threatened harm if she returned. OMR contributed a security deposit to help her relocate.

OMR In The News 2017

One Month’s Rent helps Howard County residents facing eviction

Fatimah Waseem Contact Reporter, Howard County Times

Copyright © 2017, Howard County Times, a Baltimore Sun Media Group publication

Since the late 1960s, a book club of local women had met monthly to together roam through the pages of far-flung tales. When the group read Barbara Ehrenreich’s expose on the challenges of living on minimum wages, they knew the story would have real-life consequences for themselves and for local residents struggling to overcome poverty. In her book, “Nickel and Dimed,” Ehrenreich goes undercover to work unskilled jobs — as a waitress in Florida and a Walmart clerk in Minnesota — to bring to life the daily struggle of surviving on earning $7 an hour.

Inspired by Ehrenreich’s book, the group launched the One Month’s Rent Initiative, a nonprofit organization that helps low-wage earners facing eviction. We couldn’t just drop it. We had to do something,” said club member Anne Dodd, chief judge of the county’s Orphan’s Court. For more than 12 years, the group has approved donations for one month’s rent or a security deposit for individuals threatened with losing housing due to a personal, economic or medical crisis.

Washington Post on Minimum Wages & Family Apt Rentals

Here’s how much you would need to afford rent in your state

By Tracy Jan

June 8 2017

There is nowhere in this country where someone working a full-time minimum wage job could afford to rent a two-bedroom apartment, according to an annual report released Thursday documenting the gap between wages and the cost of rental housing.

Downsizing to a one-bedroom will only get you so far on minimum wage. Such housing is affordable in only 12 counties located in Arizona, Oregon and Washington states, according to the report by the National Low Income Housing Coalition.

You would have to earn $17.14 an hour, on average, to be able to afford a modest one-bedroom apartment without having to spend more than 30 percent of your income on housing, a common budgeting standard. Make that $21.21 for a two-bedroom home — nearly three times the federal minimum wage of $7.25.

“The gap between wages and rent is growing,” said Diane Yentel, president and CEO of the Washington-based National Low Income Housing Coalition, which has conducted similar analyses for 28 years. “There’s no doubt that the affordable housing crisis overall has increased since the foreclosure crisis in 2007.”

The report details how much a household must earn to be able to afford rent in every metropolitan area and county in the country. Renters in the U.S. make, on average, $16.38 an hour.

OMR In The News 2015

Group seeks to expand the reach of One Month’s Rent

By Janene Holzberg, For The Baltimore Sun janeneholzberg76@gmail.com Copyright © 2015, The Baltimore Sun

When life throws hardworking low-wage earners a curve, they might end up living on the streets.

That’s the harsh reality that in 2004 spurred a local book club to take action to change these workers’ fates.

More than 11 years and a quarter-million in donations later, the One Month’s Rent Initiative has become a well-oiled machine that has helped 180 Howard County households avoid eviction and homelessness with a one-time housing subsidy during personal, economic or medical emergencies.

The founders say that the group’s success can easily be replicated by other clubs — and they’d love to show them how.

“The model we’ve set up runs so smoothly that we feel we don’t deserve all this credit,” said Anne Dodd, who helped found One Month’s Rent through the Hopewell Book Club, a 12-member group formed in 1980.

“We’d love to visit clubs that may think it’s difficult to accomplish when it’s not,” she said.

Dodd said that after reading “Nickel and Dimed: On (Not) Getting By in America,” by Barbara Ehrenreich, the book club felt compelled to be part of the solution.

In the 2001 nonfiction work, the author recounts her two years of working undercover at low-wage jobs and living in residential motels and trailer parks. Her firsthand account of the toll that lack of access to affordable housing takes shook club members to their core.